Though many are offered in short-term maturities, they can also have terms ranging from two years to more than five years.That makes them a good choice for savers with time-based goals. We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. If you want the flexibility to use your cash regularly but still maximize your savings, then a money market account could be just right. CDs are ideal for people who want to grow their savings over a fixed period without the risk of losing the principal amount. With a CD, you can earn a fixed interest rate even when the economy is in a downturn, making it an attractive option for people who have a low risk tolerance.

Pros and Cons of CD Investments

Money market accounts offer a variable interest rate that is higher than traditional savings accounts, but typically lower than CDs. CDs and money market accounts help you earn a higher guaranteed rate of return. Choosing which is the right one for you depends on your financial goals and when you’ll need access to your savings. Each of these accounts has its pros and cons, and choosing one over the other requires careful consideration of your financial goals and needs. Let’s take a look at CDs vs. money market accounts, and how each can help you realize your financial goals. Although the fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so.

Subscribe to Kiplinger’s Personal Finance

Alliant Credit Union offers CD terms ranging from three to 60 months, earning up to 4.30% APY. Alliant also offers jumbo CDs where you can earn higher rates with deposits of $75,000 or more. You can become a member for free by signing up as an Alliant Credit Union Foundation digital inclusion advocate and Alliant will make the one-time $5 contribution to the foundation on your behalf. After maturity, if your CD rolls over, you will earn the offered rate of interest for your CD type in effect at that time. Banks that badly need to borrow money pay more, while those that are flush with cash pay less.

You want to minimize your risk

An MMA is a type of mutual fund that invests in short-term, interest-bearing instruments to generate a variable yield while preserving principal. MMAs may deliver interest rates that are higher than savings accounts, but they often require a higher minimum deposit. Some accounts also require a minimum balance to receive the highest rate. With money market accounts, check out options for accessing your money.

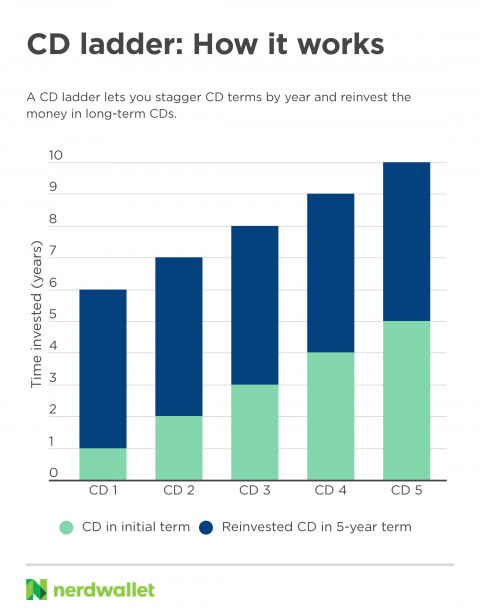

These CDs allow you to “bump up” your interest rate if rates rise during your term. This can be particularly useful in a rising interest rate environment. A CD ladder consists of an investment divided up, usually in equal amounts, into multiple CDs of staggered term lengths. Each CD term is a rung of the ladder, and usually they’re equally spaced apart. Catch up on CNBC Select’s in-depth coverage of credit cards, banking and money, and follow us on TikTok, Facebook, Instagram and Twitter to stay up to date. If you’re interested in pursuing a CD, it’s important to verify your institution’s withdrawal policies before proceeding.

They offer competitive interest rates and typically come with check-writing and debit card privileges. It’s important to compare money market accounts and CDs side-by-side to see where you’ll earn the most interest. Money market accounts often, but not always, come with a debit card, ATM card or checks, and those are options you typically don’t get with a savings account. If you want to take advantage of a high-rate environment and lock in a good APY over the long term, a CD may be one of the best options for growing your savings. The risk of both account types is low given that each typically includes FDIC insurance up to $250,000 for sole accounts and $500,000 for joint accounts. This means that even if your bank makes poor investment decisions and collapses, the FDIC ensures you will be paid back up to $250,000 for individuals or $500,000 for joint accounts.

They’re a way to invest in real estate through online brokerage accounts like these, without large upfront costs or a significant time commitment. A certificate of deposit, or CD, lets you lock in a fixed interest rate for a fixed amount of time. That’s an attractive option in today’s market, where savers can find CD rates above 5%.

- Your investment time horizon should line up with your saving or investing strategy.

- Maybe you’re thinking about a CD vs. high-yield savings account, or maybe, you’re toying with the idea of CDs vs. money market accounts.

- A lot remains to be seen, and Druckenmiller seems to be pointing out a repeat of the 1970s as more of a risk.

- Once that happens, you can withdraw your initial deposit and the interest earned or roll the total amount into a new CD.

MMAs are insured by the FDIC up to $250,000 per individual, per account at each insured institution. It is possible to lose money if you have more than that amount invested and the bank were to fail. Knowing what you need a CD or money market account to do for you can help you decide which one belongs in your savings plan. If you’ve ever heard mature investors reminisce invest in cds or money market about CD interest in the 80s, you’ve probably considered using one. Back in 1984, a five-year CD had an average interest rate of 11.74% APY and a one-year CD wasn’t far behind at 11.17% APY, according to Bankrate. These days, CD rates are far more modest with five-year and one-year CDs averaging a little over one percent with highs of 5.60% for 12 months.

She advised any listeners who are thinking of getting a CD to take advantage of the market conditions today. GOBankingRates’ editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services – our reviews and ratings are not influenced by advertisers.